A How-To Guide on Developing

Buy Now Pay Later (BNPL) Apps like Tabby

Nov 8, 2024The pivoting change in digital payments and the push for financial flexibility have made Buy Now Pay Later (BNPL) services increasingly popular globally. This has made increased customer satisfaction and sales as there is an option to purchase goods that you can pay later or in installments. One of the leading names among this is Tabby – a highlighted BNPL platform in the Middle East.

Let us see how to develop an app like Tabby with the necessary features, and development costs and why Nuox Technologies in Dubai can be your partner for mobile app development.

BNPL Apps – 101

BNPL apps have changed the way for customers to shop by allowing them to make purchases and defer payments with different options. With their user-friendliness, these apps like Tabby and Tamara gained popularity. Tabby and Tamara are two prominent BNPL services making waves in the UAE’s digital payment landscape. Both platforms offer consumers the flexibility to shop and pay in installments, enhancing their purchasing power without immediate financial strain.

While Tabby partners with renowned brands such as IKEA, H&M, and Carrefour, Tamara similarly collaborates with top retailers to provide seamless, interest-free payment options. These apps have significantly boosted e-commerce and in-store shopping experiences in the UAE, making flexible payments more accessible and popular among consumers. As of 2024, BNPL has more exponential growth with more consumers opting for flexibility over traditional credits.

What is Tabby?

Tabby is a popular BNPL app that has been reshaping the shopping landscape in the Middle East. By partnering with many leading and recognized brands, the Tabby app gives users the convenience of paying for goods in four interest-free installments or within 14 days. This easy process makes high-value purchases more manageable and accessible to all.

Why Use Tabby App?

Tabby gives the option to receive their goods upfront and the flexibility to pay later with a predetermined schedule. There is an option to pay in four installments or within 14 days which provides an interest-free option for users. Tabby has a strong partnership with retailers like IKEA, H&M, Shein, Namshi, AliExpress, BabyShop, Nike, Sephora, Home Center, Lacoste, Carrefour, etc. This enhances customer trust and widens the app’s reach.

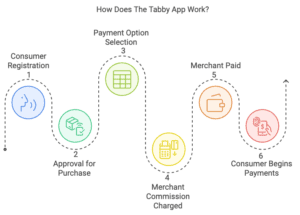

How Does the Tabby App Work?

You need to understand how the Tabby app works to develop an app like BNPL. To use Tabby you need to download the app, create an account, register with personal details and verify the documents. With that done, you can assess the consumer’s creditworthiness before the approval of a purchase. Then the user can select their preferred payment method that is provided. And Tabby will charge the merchant a commission for facilitating these transactions. With Consumer Payment the user can pay in installments as per the chosen schedule.

How to get a Tabby Card?

- Download the Tabby app and sign up

- Tap Get your card on the home screen

- Complete the one-time setup and verify your identity

To get a Tabby Card, you need to,

- Be at least 18 years of age

- Have a valid Emirates ID and Be a UAE resident.

- Have a valid debit or credit card to link for Tabby’s repayments

- Have a good credit history

Must-Have Features for Buy Now Pay Later Apps in UAE

You need some vital functionalities to develop an app like Tabby.

- User-friendly Onboarding: Easy signup and account creation.

- Secure Payment Gateway: To protect user data and ensure a reliable and safe payment process.

- Installment Options: Flexible payment choices like multi-installment or delayed full payment.

- Notification and Alert: Notify users about upcoming payments and account updates.

- Detailed Payment History: Track all transactions for transparency.

- Customer Support: Accessible assistance for all issues and queries.

- Data protection: Compliance with industry standards for data security and user privacy.

Breaking Down the Costs: What Affects the Development of Buy Now Pay Later Apps in UAE?

- App Complexity: Features like biometric login, AI-based credit checks, and detailed dashboards can add to the development time and cost.

- Design: A sleek, user-friendly interface with intuitive navigation enhances the user experience but can increase costs.

- Security Protocols: Incorporating top-tier security features for safe transactions is essential and can be costly.

- Integrations: Linking with various payment gateways and merchant platforms can also impact the budget.

- Regulatory Compliance: Ensuring adherence to local and international financial regulations adds to development time and cost.

If you are considering developing a BNPL app like Tabby, you can partner up with Nuox Technologies, the best Mobile App Development in Dubai. As an established leader in developing high-quality, customized mobile applications, Nuox Technologies has expertise with a proven track record of creating secure, innovative financial apps with any prerequisites. With End-to-end Services Nuox provides comprehensive support from ideation and design to development and post-launch support. With advanced technology, Nuox provides you with a BNPL app that meets global standards.

Conclusion

Creating a BNPL app such as Tabby can lead to new business prospects and give customers the financial flexibility they desire. The secret to success is incorporating necessary features, comprehending cost drivers, and selecting a trustworthy development partner like Nuox Technologies.

FAQs

- How much time does it take to create a BNPL application?

The app’s complexity may affect the development duration, however it typically takes six to twelve months. - How secure is a BNPL app?

Robust encryption, two-factor authentication, and compliance with data protection policies are the norm. - How much would it cost to create an app similar to Tabby?

The price of development would vary based on the features and integrations, from $50,000 to $200,000 or more. - How can BNPL apps ensure user trust?

Providing clear terms, transparent transactions, and strong data protection helps build trust among users. - Can Nuox Technologies help with ongoing maintenance after development?

Yes, Nuox offers post-launch support and app maintenance to ensure continued functionality and security.